Arrears Definition, Meaning & Synonyms

Contents:

The alternative to this would be “current pay”, in which employers pay their employee the day the pay week ends. This means an employer would need to submit an employees’ time before the they even finish their work week. Maharashtra government approves 6 per cent hike in DA for MSRTC employeesThe hike will put a financial burden of Rs 15 crore per month on the state-owned public transport body. Shrirang Barge, a union leader, said they were happy with the decision though it was pending for four months. “MSRTC employees should also get dearness allowance arrears as in the past the state government has not paid it,” Barge said. The present value of an annuity is the current value of future payments from that annuity, given a specified rate of return or discount rate.

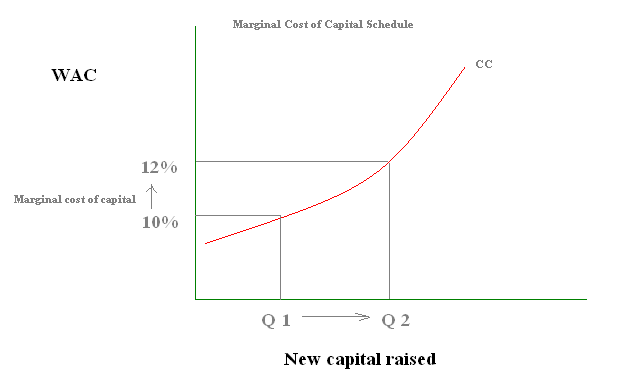

An annuity such as a loan repayment is a series of equal amounts of payment that occurs at equal time intervals—say for $250 per month for 10 years. If the annuities are due at the end of the period such as mortgage payments, they are called an ordinary annuity or annuity in arrears. There are also instances where bills or liabilities come due after the service has been provided such as utility bills, property taxes, and employee salaries.

Arrears is a financial and legal term that most commonly describes an obligation or liability that has not received payment by its due date. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas. By staying on top of payments due and payments owed, you can conduct arrears billing with ease to avoid any unnecessary errors or discrepancies. Payment in arrears is a billing method where payment for a transaction is due after the goods or services have been delivered by the supplier. Information provided on Forbes Advisor is for educational purposes only.

A prudent agreement that covers the terms of payment in arrears will also list penalties in case the payments are delayed to the service provider. The arrears due to be paid will then be inclusive of the said penalties and fees while also considering any partial payments made towards fulfilling the service. Arrears is a legal term for the part of a debt that is overdue after missing one or more required payments. The amount of the arrears is the amount accrued from the date on which the first missed payment was due. The term is usually used in relation with periodically recurring payments such as rent, bills, royalties , and child support.

Paid in Arrears Example

It’s good to understand both of these uses of arrears in accounting, so that you know how to apply them to your own business situation. Somewhere between the case of an isolated bankruptcy and mass default (Indonesia, with 70% of businesses in arrears) is the borderline between individual and systemic bankruptcy. China appears to be up to date in its payments; there are no amounts in arrears from prior years on WHO’s report.

It’s a strange-to-pronounce and possibly unfamiliar term, but being paid in arrears is a common practice that you have likely experienced at some point. Simply put, it means to pay for goods or services after the terms have been met or the due date has passed. It’s not unusual to see paid in arrears pop up in small business accounting or payroll, and there are several other instances where you may find yourself interacting with this term. One just needs to add the outstanding amount due for the period and any possible penalties for late payment such as interest and late payment fees, and finally reduce any partial payment made during that period.

Free Accounting Courses

Arrears refers to payments that are overdue and that are supposed to be made at the end of a given period after missing out on the required payments. Total arrears equals the sum of all the payments that have accumulated over time since the first payment was due. The term can be used in relation to various costs such as rent payments, water bills, child support, royalties, dividends, loan repayments, etc. Arrears can also be applied to instances in the context of finance.

Shamed Stephen Bear’s huge debt revealed as star works for 60p an hour in prison… – The Sun

Shamed Stephen Bear’s huge debt revealed as star works for 60p an hour in prison….

Posted: Mon, 27 Mar 2023 13:59:24 GMT [source]

Similarly, mortgage interest is paid in arrears, meaning each monthly payment covers the principal and interest for the preceding month. As noted above, arrears generally refers to any amount that is overdue after the payment due date for accounts such as loans and mortgages. Accounts can also be in arrears for things like car payments, utilities, and child support—any time you have a payment due that you miss. While paying in arrears has numerous benefits from a payroll perspective, it can be a burden to employees who are stuck waiting to be paid for work they completed days or weeks before. Depending on the industry and type of work, choosing to pay in advance might make more sense than paying in arrears. Different circumstances call for different types of payments, including paying in arrears.

What It Means to Be in Arrears, With Example

In the case of prepaid phone bills, rents, leases etc. payments in advance are very common. However, arrears are those payments that are not made by their due date and are termed as arrears. The payment may also be referred to as a singular arrear not classified as a late payment. Other examples of payments in arrears include postpaid phone service, postpaid water bills, postpaid electricity bills, property taxes, etc.

- Currently, the service department and some part-timers are paid two weeks in arrears.

- The government then recoups the payment from the non-resident parent and bears the burden of missed payments and arrears.

- TCC agreed to buy one shipment of textile material from TTC for $1000.

- Because there’s no gap between the end of a pay period and the day employees get paid, employers will have to predict employee hours.

- On the contrary, a standard swap sets the interest rate at the beginning and pays the interest at the end.

The dividends in arrears must be disclosed in the footnotes to the financial statement. The company is also restricted from making any dividend payouts to common shareholders until it settles its dividends payable account. Being in arrears may or may not have a negative connotation depending on how the term is used. In some cases, such as bonds, arrears can refer to payments that are made at the end of a certain period.

401 and Retirement Help employees save for retirement and reduce taxable income. Employee Benefits Offer health, dental, vision and more to recruit & retain employees. Business Insurance Comprehensive coverage for your business, property, and employees. Car EMI payments, credit card payments, taxes, mortgage, and payroll are the type of payments that can be in arrears. An arrears swap is preferred by speculators who predict the yield curve and receive interest payments at the end of the coupon period.

Paying in arrears also ensures employees complete the work they’re responsible for. When paying in advance, you could end up paying for incomplete work. You may make payments to vendors in arrears, and you may also pay your employees in arrears. A payment is made later than the agreed-upon terms of an arrangement or contract, which means a business has fallen behind on its payments. To calculate the amount due for payment in arrears for TCC, we can use the calculation mentioned earlier in the article. After it signed the agreement, TCC made the payments promptly for three months.

An annuity is a transaction of equal amounts occurring at equal intervals over a certain period of time. Arrears is a term often used in a legal context — like, when you’ve had to hire a lawyer because you’re being sued by your landlord, or being evicted because you’re in arrears on your rent. Before it comes to eviction, though, you should try negotiating with your landlord first. They would probably be more interested in collecting arrears, even late, than in evicting you and starting with a new tenant from scratch. Once you’ve gotten into the cadence of arrears payroll, your employees will most likely not notice that the previous week’s hours are next week’s payroll. Arrears payroll is the cadence of running the past week’s payroll instead of the current week, or any kind of delayed payroll schedule.

I have https://1investing.in/ advance amount in advance, still they are charging bpsc as well. When any shareholder does not pay his/her call money to company on his/her due date. At that time, company will deduct that calls in arrears from total called up capital for showing net paid up capital in balance sheet. Arrears accounting provides you with what you need now while allowing you breathing space to meet your obligations later. Eligible customers would receive a $25 monthly credit toward current water bills with any arrears suspended for one to two years. Or, your loan could be recalculated and the arrears added to the loan balance, which might make your monthly payments go up.

Advance means the amount of money is paid before the service is rendered and arrears means the amount is not paid by its due date. Other sources of income, mainly assessment and excise taxes, proved insufficient to pay parliament’s soldiers regularly and wages fell steadily in arrears throughout the conflict. Their contribution rates are already 30 % of payroll, fully spent and many enterprises are in arrears. Future value is the value of a current asset at a future date based on an assumed rate of growth over time.

Dividend in Arrears

“Apart from that, mills also have to pay accumulated arrears of previous years, pegged Rs 850 crore,” said a senior food ministry official. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. However, when hard times hit in the middle of the 1620s he began to fall into arrears on his rents. Families drew on various sorts of credit – they fell into arrears of rent, they borrowed from shops, dealers, and neighbours. However, rent direct reduced landlords’ rent collection costs and minimised the possibility of rent arrears.

arrears fees meaning payable refers to the money a company owes to its creditors. If you’re paying in arrears on accounts payable, making these payments on time is crucial. If not, these late payments can face some consequences, such as increased interest rates, negative cash flow impacts, payment term restrictions, poor relationships, negative reputation, and inaccurate financial records. When two parties come to an agreement in a contract, payment is usually made before or after a product or service is provided.

NiSource Closes on Bond Offering – PR Newswire

NiSource Closes on Bond Offering.

Posted: Fri, 24 Mar 2023 20:14:00 GMT [source]

The latest product innovations and business insights from QuickBooks. The tools and resources you need to take your business to the next level. The tools and resources you need to run your business successfully.